The Chase Sapphire Preferred® Card has long been a dominant force in the travel rewards credit card market, and for good reason. It consistently offers a compelling blend of valuable rewards, comprehensive travel protections, and a reasonable annual fee.

Current Welcome Offer

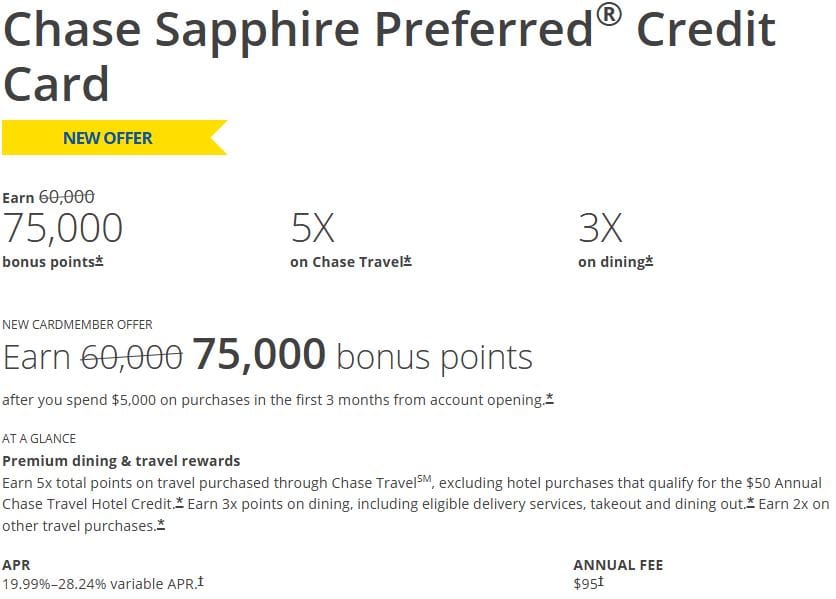

As of July 2025, the Chase Sapphire Preferred® Card is offering a sign-up bonus of 75,000 Ultimate Rewards® points after you spend $5,000 on purchases in the first 3 months from account opening. This is a significant offer, with a value of at least $937.50 when redeemed for travel through the Chase Ultimate Rewards® portal.

Earning Rewards

The card’s rewards structure is designed to benefit frequent travelers and diners:

- 5x points on travel purchased through Chase Ultimate Rewards®.

- 3x points on dining at restaurants, including eligible delivery services, takeout, and dining out.

- 3x points on online grocery purchases (excluding Target, Walmart, and wholesale clubs).

- 3x points on select streaming services.

- 2x points on all other travel purchases.

- 1x point on all other purchases.

Additionally, you’ll receive a 10% anniversary points boost. Each account anniversary, you’ll earn bonus points equal to 10% of your total purchases made the previous year. For example, if you spend $25,000 on purchases, you’ll get 2,500 bonus points.

Redeeming Rewards

Chase Ultimate Rewards points are highly flexible and valuable. Here’s how you can use them:

- Chase Ultimate Rewards® Travel Portal: Get 25% more value when you redeem your points for airfare, hotels, car rentals, and cruises through the Chase portal. This makes each point worth 1.25 cents.

- 1:1 Point Transfers: Transfer your points at a 1:1 ratio to a variety of airline and hotel partners, including:

- Airlines: United MileagePlus®, Southwest Rapid Rewards®, British Airways Executive Club, and more.

- Hotels: World of Hyatt®, Marriott Bonvoy®, and IHG® Rewards Club.

- Cash Back: Redeem points for cash back at a rate of 1 cent per point.

- Gift Cards and Merchandise: Redeem for gift cards and merchandise, though the value may be less than other redemption options.

Key Benefits

The Chase Sapphire Preferred® shines with its comprehensive travel and purchase protections:

- $50 Annual Hotel Credit: Receive up to $50 in statement credits each account anniversary year for hotel stays purchased through Chase Ultimate Rewards®.

- Primary Auto Rental Collision Damage Waiver: This is a standout benefit. When you rent a car and pay with your card, you can decline the rental company’s insurance and be covered for theft and collision damage.

- Trip Cancellation/Interruption Insurance: If your trip is cut short or canceled due to sickness, severe weather, or other covered situations, you can be reimbursed up to $10,000 per person and $20,000 per trip.

- Baggage Delay Insurance: If your baggage is delayed by more than six hours, you can be reimbursed for essential purchases like toiletries and clothing, up to $100 a day for five days.

- Trip Delay Reimbursement: If your common carrier travel is delayed more than 12 hours or requires an overnight stay, you and your family are covered for unreimbursed expenses, such as meals and lodging, up to $500 per ticket.

- Purchase Protection: Covers your new purchases for 120 days against damage or theft, up to $500 per claim and $50,000 per account.

- Extended Warranty Protection: Extends the time period of a U.S. manufacturer’s warranty by an additional year on eligible warranties of three years or less.

- No Foreign Transaction Fees: You won’t pay any extra fees on purchases made outside the United States.

Annual Fee

The Chase Sapphire Preferred® Card has a $95 annual fee. But the card gives you a $50 credit every year if you book hotel using Chase Ultimate Rewards Website. Technically that makes the annual fee only $45. Plus the welcome offer takes care of at least 7 years of annual fees. Overall the benefit outweighs the annual fee.

Who is this card good for?

The Chase Sapphire Preferred® is an excellent choice for:

- Travelers who want a versatile rewards card: The combination of strong earning rates, flexible redemption options, and valuable transfer partners makes it a great all-around travel card.

- Those new to travel rewards: The card is relatively straightforward to use and offers a great introduction to the world of points and miles.

- People who value travel protections: The primary auto rental insurance and trip cancellation/interruption coverage can provide significant peace of mind.

Who might want to look elsewhere?

- Infrequent travelers: If you don’t travel often, you may not get enough value from the card’s benefits to justify the annual fee. A no-annual-fee cash-back card might be a better option.

- Big spenders seeking luxury perks: If you’re looking for benefits like airport lounge access or annual travel credits that fully offset the annual fee, you might consider a premium travel card like the Chase Sapphire Reserve or Venture X. Follow my review to learn more about Venture X card.

How it Compares

- vs. Capital One Venture Rewards Credit Card: The Venture card offers a simple 2x miles on every purchase, which can be appealing for those who don’t want to track bonus categories. However, the Sapphire Preferred’s bonus categories and valuable transfer partners can offer more potential value for strategic redeemers. Venture Rewards card has a $95 annual fee as well.

- vs. American Express® Gold Card: The Amex Gold has a higher annual fee ($325) and focuses heavily on dining and U.S. supermarket spending. The Sapphire Preferred is a more well-rounded travel card with broader travel bonus categories and more comprehensive travel insurance.

The Verdict

The Chase Sapphire Preferred® Card remains a top contender in the travel rewards space in 2025. Its combination of a generous sign-up bonus, strong earning rates, flexible redemption options, and valuable travel protections makes it a fantastic choice for a wide range of travelers. While it may not have the flashy perks of more premium cards, its $95 annual fee is easily justified by the value it provides. If you’re looking for a reliable and rewarding travel card, the Chase Sapphire Preferred® is hard to beat.

If you found this review helpful and planning to apply for the card, please use the referral link.